Weaker Euro and month-end demand keep the greenback bid

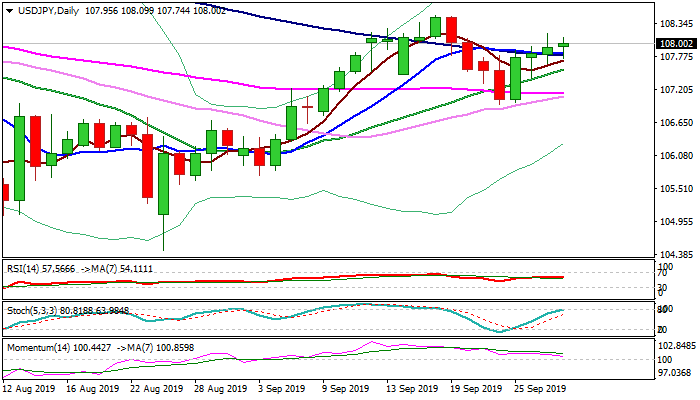

Monday’s action moves within 35-pips range under new one-week high at 108.18 on Monday but remains in green for the fourth straight day.

The greenback remains bid due to month-end demand, Euro and underpinned by fresh weakness of Euro, hit by weaker than expected German data.

Daily chart shows bullish momentum and stochastic entering overbought territory, which conflict latest attempts higher, as Monday’s action underpinned bullish setup of daily Ichimoku studies and Friday’s close above 107.89 pivot (Fibo 61.8% of 108.47/106.96 bear-leg).

Fresh bulls need sustained break above 108 barrier to open way towards key near-term barrier at 108.47 (18/19 Sep double-top).

Near-term action needs to hold above converged 10/100DMA’s (107.82), with repeated close above cracked 107.89 Fibo barrier, needed to maintain bullish bias.

Conversely, bulls may start to lose traction and generate initial signal of recovery stall on return and close below 107.82.

Release of Japan’s jobs data and Tankan index, due later today, would provide fresh signals.

Res: 108.18; 108.47; 108.83; 109.05

Sup: 107.89; 107.82; 107.56; 107.42