WTI bounces on news about lower output but recovery was so unable to hold gains

WTI oil price bounced on Monday after hitting new multi-month low at $59.25 last Friday, as news that Saudi Arabia will reduce its output in December by 500,000 barrels per day.

The announcement on output cut due to seasonal lower demand, but also signs that lower production may extend into 2019, boosted oil price to $61.27 on Monday.

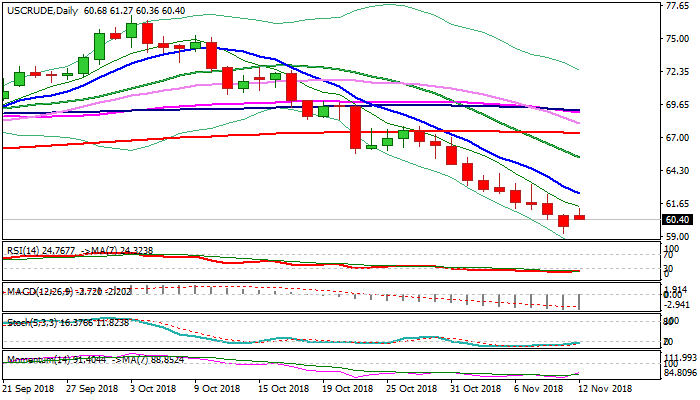

Bounce was so far unable to hold gains and more significantly dent larger bears (WTI was down 11.5% in Oct fell further nearly 7% in the first week of Nov), driven by very strong bearish sentiment on strong global supply and minor impact from US sanctions on Iran which started last week.

Overextended daily studies warn of corrective action but lacking stronger signals for now and keeping bearish bias intact.

Repeated close below psychological $60 handle would add to negative outlook for test of strong supports at $58.38 (100WMA) and $58.06 (09 Feb trough).

On the other side, stronger bullish signal could be expected on recovery extension through falling 10SMA ($62.45), as sustained break here would sideline bears for stronger corrective action.

Res: 61.00; 61.27; 62.45; 63.17

Sup: 60.00; 59.25; 59.02; 58.38