WTI maintains positive tone and eyes 100WMA

WTI oil bounced on Monday following short-lived probe below $57 handle (session low at $56.95) and aiming towards last Friday’s high at $57.79 (the highest since mid-Nov 2018).

Optimistic tones from US/China trade talks and production cut by main world oil exporters, for now offset negative signals from rising US oil output and maintain bullish bias.

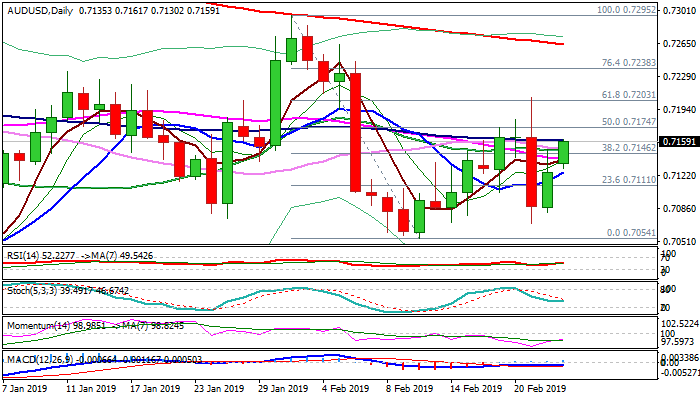

Bullish daily techs continue to support for attack at targets at $58.14/32 (16 Nov lower high / 100WMA), however, reversal of daily stochastic from overbought territory may delay bulls.

Extended consolidation above broken 100SMA ($56.19) would keep bulls intact, as support is reinforced by rising 10SMA ($55.96) on track to form bull-cross and further boost bulls.

Res: 57.79; 58.14; 58.32; 59.62

Sup: 56.95; 56.64; 56.19; 55.96