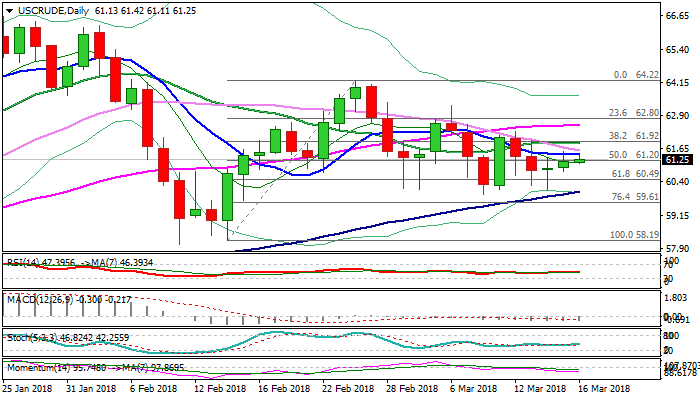

WTI OIL attempts again into daily cloud but negative techs warn of stall

WTI oil holds steady on Friday and remains in green for the third straight day, driven higher by weaker dollar.

Fresh attempts into daily cloud come after Thursday’s probe through cloud base ($61.23) and spike to $61.53 proved to be false break.

The action was so far capped by 10SMA ($61.42) which limited upticks in previous two sessions and guards a cluster of barriers above, provided by daily MA’s (30/20/55SMA) within $61.57 and $62.56.

Fresh extension higher is unlikely to sustain break through cloud top and extend higher as daily MA’s are in bearish configuration and negative momentum studies continues to weigh.

Negative signal could be expected on repeated failure to close above cloud base, which would turn near-term bias bearish and re-expose strong $60.00 support zone (recent multiple downside rejections / rising 100SMA).

Bullish scenario sees close above cloud base as minimum requirement, which would be boosted by break above 10SMA, to open way for stronger recovery and test of barriers at $61.57 (30SMA); $61.84 (20SMA) with possible extension towards $62.55 (55SMA) on stronger bullish acceleration.

Res: 61.42; 61.57; 61.84; 62.55

Sup: 61.11; 60.80; 60.49; 60.11