WTI OIL – bearish alignment but daily cloud base holds for now; supply data in focus

WTI oil maintains negative tone on Tuesday, pressured by news of another increase in US oil production.

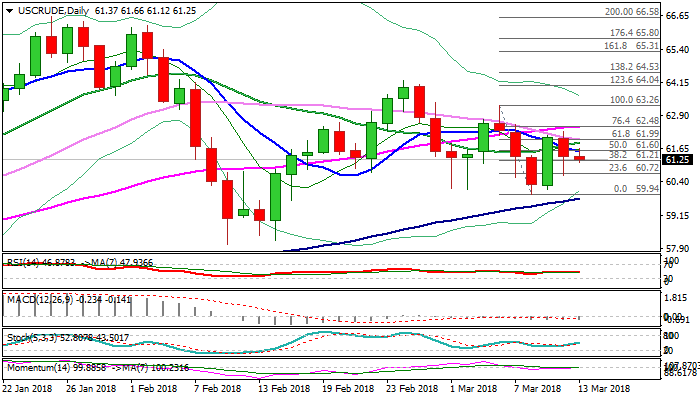

Today’s action was so far contained by the base of thick daily cloud at $61.20 and is shaped in tight Doji candle.

Cloud base acts as solid support as Monday’s break below cloud on spike to daily low at $60.65, proved to be short lived, as the day closed above cloud base.

Daily techs re mixed, with MA’s holding above the price in bearish setup while Momentum and RSI are neutral.

Today’s action was so far capped by falling 10SMA which marks initial resistance at $61.57, followed by 20&30SMA’s at $61.87 / $62.00, break of which will be more bullish.

Negative scenario sees close below the cloud as bearish signal for extension towards cracked strong supports at $60.00 zone.

Oil supply data are in focus, with API crude stocks report due late today and EIA weekly crude stocks report due on Wednesday.

Res: 61.57; 61.87; 62.00; 62.49

Sup: 61.12; 60.72; 60.12; 59.94