WTI OIL – bears cracked key supports; weekly crude stocks report eyed for fresh signals

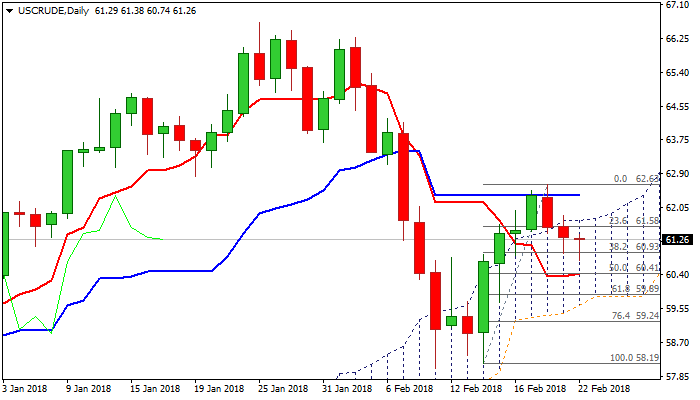

WTI oil price fell further on Thursday, driven by stronger dollar and probed below pivotal support at $60.93 (Fibo 38.2% of $58.19/$62.63 upleg).

Today’s dip was contained by 10SMA ($60.75) with subsequent bounce signaling hesitation at strong $60.93/75 support zone.

However, the price remains within daily cloud which was penetrate yesterday with bearishly aligned daily techs keeping negative near-term outlook.

EIA weekly crude stocks report will be released today and expected to show another build in oil inventories which could have negative impact on oil price.

Firm break below cracked $60.93/75 supports would signal fresh bearish extension towards $60.71 (daily Tenkan-sen) and key supports at $59.89/84 (Fibo 61.8% of $58.19/$62.63 / daily cloud base).

Daily cloud top marks significant resistance at $61.73 which is expected to cap extended upticks.

Only break and close above cloud would sideline near-term bears and shift focus higher.

Res: 61.38; 61.73; 62.00; 62.35

Sup: 60.93; 60.75; 60.41; 59.89