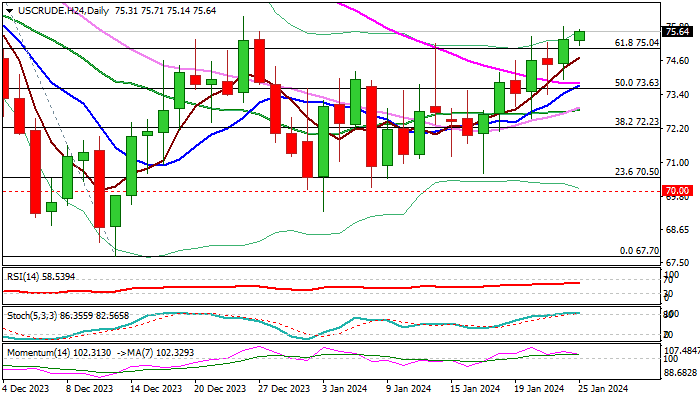

WTI OIL – bulls hold grip but may take a breather on overbought daily studies

WTI oil remains at the front foot and trading near one-month high, posted on Wednesday, after release of crude inventories report.

Much stronger than expected drop in US crude stocks, mainly caused by bad weather, added to existing bullish near-term structure and lifted the price above pivotal Fibo barrier at $75.04 (61.8% of $79.57/$67.70 descend).

Fundamentals remain supportive as the latest data added to bullish stance, driven by supply concerns over the war in the Middle East, though technical studies on daily chart are overbought and positive momentum is fading, which signals that bulls may run out of steam soon and pause for consolidation.

Bulls eye initial targets at $76.16/77 (Dec 26 high / Fibo 76.4%) which guard more significant barrier at $77.42 (200DMA).

Converged 10/55DMA’s ($73.72/78) are about to for a bull-cross and provide solid support which should contain dips and keep larger bears in play.

Res: 76.16; 76.77; 77.42; 78.13

Sup: 75.04; 74.22; 73.72; 72.79