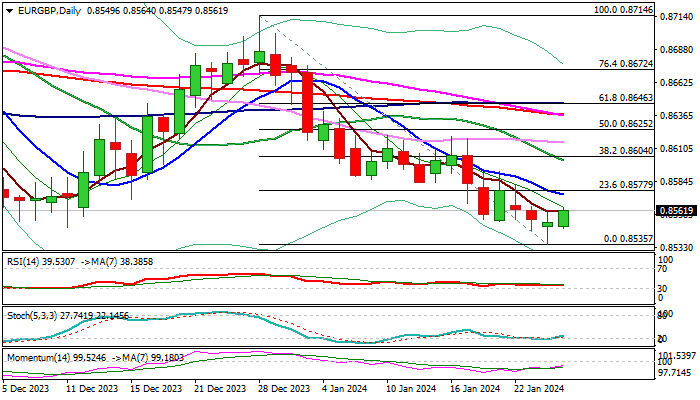

EURGBP – initial reversal signals need more work at the upside for validation

EURGBP rose in early Thursday’s trading, adding to initial signal of formation of reversal pattern on daily chart, after Wednesday’s action ended in long-legged Doji candle, signaling indecision.

Oversold studies contributed to fresh profit-taking, though 14-d momentum is still in negative territory, signaling that underlying bears remain firmly in play for now.

Fresh gains see violation of initial resistances at 0.8574/77 (falling 10DMA / Fibo 23.6% of 0.8714/0.8535 bear-leg) as a minimum requirement to spark stronger recovery and expose next pivotal barriers at 0.8600 zone (descending 20DMA / Fibo 38.2%).

Otherwise, limited correction is likely to offer better selling opportunities for continuation of larger downtrend from 0.8714 (Dec 28 peak).

Res: 0.8574; 0.8592; 0.8604; 0.8625

Sup: 0.8535; 0.8523; 0.8499; 0.8471