WTI OIL – corrective dips seen as positioning for fresh rally

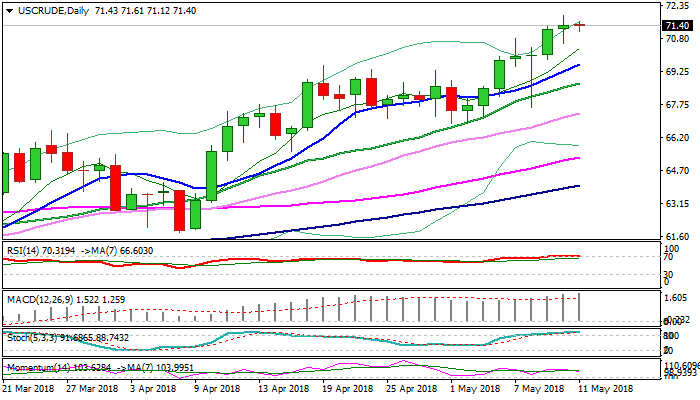

WTI oil is holding within tight consolidation range under new 3 ½ year high at $71.86 on Friday, taking a breather after strong rally during the week.

Oil price was boosted by US decision to pull out of nuclear deal with Iran which caused strong uncertainty about global oil supply and strong fall in US crude stocks.

Strong bullish sentiment could drive oil price higher for test of targets at $74.94 (Oct 2011 low) and $76.35 (Fibo 61.8% of 107.45/$26.04 fall).

Meanwhile, corrective actions on profit-taking after strong rally in past two weeks and overbought daily studies could be anticipated.

Dips are expected to provide better buying opportunities and should be contained by rising 10SMA ($69.60).

Res: 71.61; 71.86; 72.24; 73.00

Sup: 71.12; 70.55; 70.00; 69.60