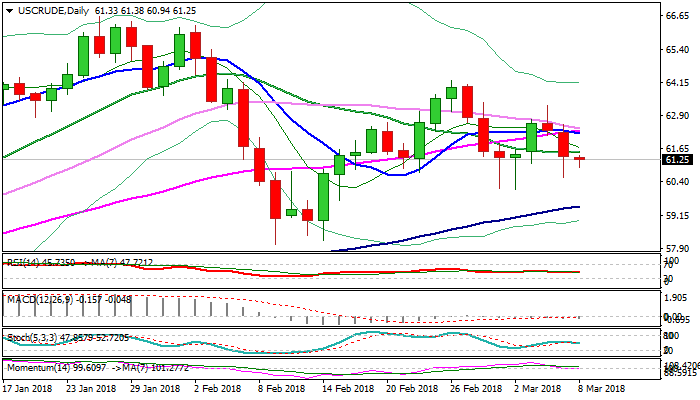

WTI OIL – daily cloud base holds for now but risk for further weakness persists

WTI oil remains in red on Thursday as negative sentiment increased after downbeat supply data on Wednesday, which added to existing pressure on concerns over possible trade war.

Fresh downside attempts on Thursday were so far contained by the base of thick daily cloud ($60.91) after previous day’s dip to below cloud base was short-lived.

Techs continue to work in favor of bears as daily MA’s returned to bearish setup and 14-d momentum is probing into negative territory.

Bears look for eventual close below cracked support at $61.32 (Fibo 61.8% of $60.12/$63.26 upleg) to generate fresh bearish signal which would be reinforced by close below cloud base, for final push towards key support at $60.12 (02 Mar trough).

Immediate downside risk would remain on hold while cloud base hold, but close above broken 20SMA ($61.55) is needed generate initial bullish signal.

Res: 61.55; 61.91; 62.25; 62.63

Sup: 60.91; 60.57; 60.12; 59.48