WTI OIL – downside remains vulnerable despite quick bounce after Wednesday’s post-data spike lower

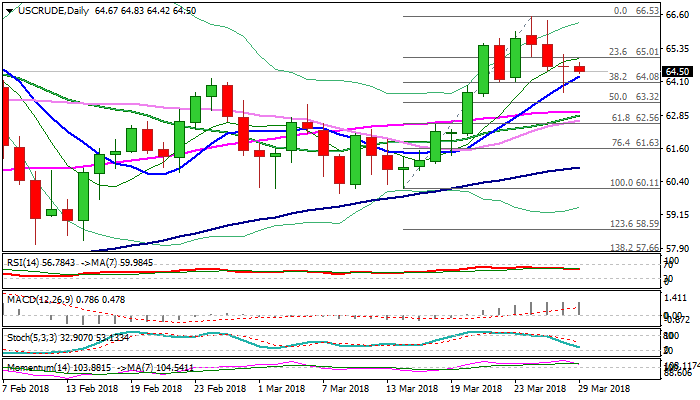

WTI oil stands at the back foot on Thursday and keeps the downside vulnerable. The price spiked to new low at $63.71 after surprise build in crude stocks on Wednesday (EIA report showed crude inventories rose by 1.6 million barrels vs forecast for 0.28 million barrels draw) but bounced quickly and recovered all post-data losses.

Wednesday trading ended in long-legged Doji, signaling strong indecision, however, bears kept control and keep in play risk for renewed probes through cracked 10SMA ($64.28) and Fibo 38.2% of $60.11/$66.53 ($64.08) to generate fresh bearish signal on break.

South-heading daily techs continue to support this scenario.

On the other side, strong downside rejection on Wednesday could be seen as initial stall signal of corrective pullback from $66.53, as latest news that OPEC-led action in reducing oil output would continue through 2018 and may extend in 2019, offered fresh support.

Bullish scenario needs pullback to remain above $64.08 Fibo support and to extend above $65.45 (Fibo 61.8% of $66.53/$63.71) to generate stronger reversal signal ant shift near-term focus higher.

Res: 64.83; 65.11; 65.45; 65.86

Sup: 64.28; 64.08; 63.71; 63.32