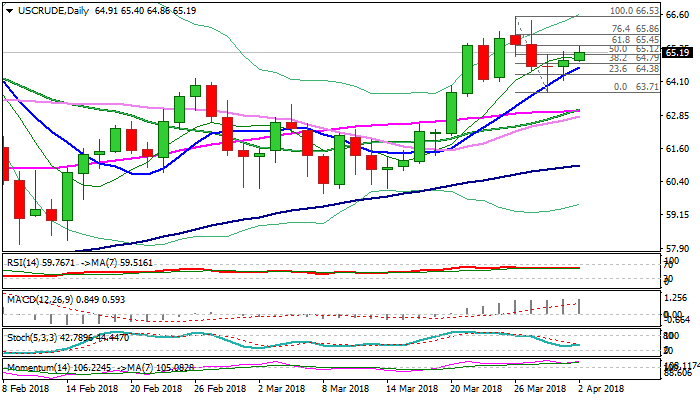

WTI OIL extended recovery pressures pivotal Fibo barrier at $65.45

WTI oil maintains positive tone on Monday and extends recovery from last week’s correction low at $63.71.

Oil price regained momentum after pullback from $66.53 peak stalled on attempts through important Fibo support at $64.08 and subsequent bounce extended to $65.40 on Monday, retracing nearly 61.8% of $66.53/$63.71 pullback.

Concerns about reintroducing US sanctions against Iran and drop in drilling activity in the US (last Thursday’s release of Baker Hughes report showed a number of oil rigs dropped to 798 from 804), keep near-term action supported.

Bullish daily techs are supportive, as rising 10SMA / thick 4-hr cloud contained last week’s correction and continues to track fresh advance, offering initial supports at $64.82 (cloud top) and $64.62 (10SMA).

Recovery rally needs close above $65.45 (Fibo 61.8% of $66.53/$63.71 pullback) to generate fresh bullish signal and expose key barriers at $66.64/53 (25 Jan / 26 Mar peaks) and $66.75 (50% retracement of 107.45/$26.04 fall).

Near-term structure would weaken on break below rising 10SMA, while stronger bearish signal could be expected on close below $64.08 (Fibo 38.2% of $60.11/$66.53 rally).

Res: 65.45; 65.86; 66.00; 66.53

Sup: 64.82; 64.62; 64.08; 63.71