WTI OIL may extend consolidation before larger bulls resume

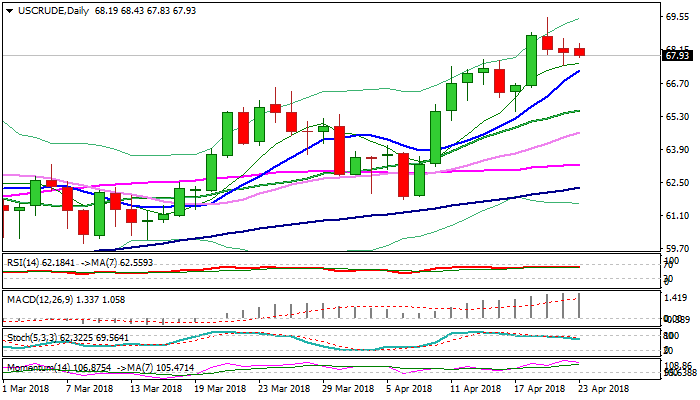

WTI oil stands at the back foot on Monday, following two-day pullback from new over three-year high at $69.54, but holds for now above Friday’s spike low at $67.48.

Easing from new high is seen as consolidative/corrective action on overbought techs, but is also supported by rising number of US rigs which signals increased output and US sanctions against key oil producers such as Russia and Iran.

However, dips were so far shallow and contained above initial support-rising 10SMA (currently at $67.26), keeping overall bullish structure intact.

Pullback could extend towards $67.00/$66.50 zone before bulls re-take control for eventual attack at psychological $70 barrier.

Alternatively, loss of $67.00/$66.50 pivots would risk deeper correction towards $65.55 (17 Apr trough / rising 20SMA) and put larger bulls on hold.

Res: 68.43; 68.64; 68.89; 69.54

Sup: 67.83; 67.26; 67.00; 66.50