WTI oil price falls 6% on recession and demand fears

WTI oil price was sharply down on Tuesday, losing over 6% until early US session hours, under increased pressure from strong dollar, growing fears of recession and fresh Covid restriction in a number of Chinese cities that raises concerns about lower demand.

On the other side, most of OPEC producers are pumping at maximum capacity, with little hopes that US President Biden’s visit to Saudi Arabia next week would result in output increase by Saudi Arabia and UAE, after the US increased pressure on the cartel to increase production to cover shortage in the market from ban of Russian oil.

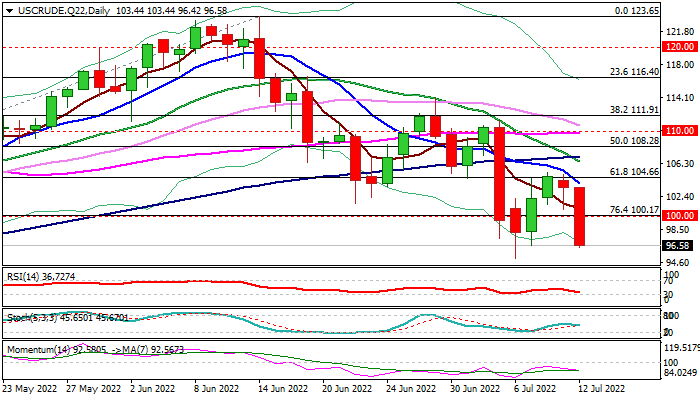

The picture is increasingly bearish on daily chart, as today’s strong acceleration almost fully reversed last week’s recovery.

The price returned again below psychological $100 level, with close below to reinforce bearish stance for break of pivotal support at $95.09 (July 6 spike low) that would open way for attack at key supports at $93.67 (200DMA) and a higher base at $92.92/$92.64 (lows of Apr 11 / Mar 16), loss of which would generate strong bearish signal.

Broken $100 level reversed to strong resistance, followed by falling 10DMA ($103.88) and recovery top at $105.21, which marks upper pivot.

Res: 98.17; 100.00; 101.52; 103.25

Sup: 95.09; 93.67; 92.92; 92.64