WTI oil price falls sharply, on track for the biggest daily loss since mid-November

WTI oil price fell nearly 5% on Monday, deflated by decision of top oil exporter, Saudi Arabia, to cut February selling price to Asia to the lowest in over two years and rise in OPEC output.

The measures partially counter persisting supply fears over rising geopolitical tensions in the Middle East and may limit the latest price drop.

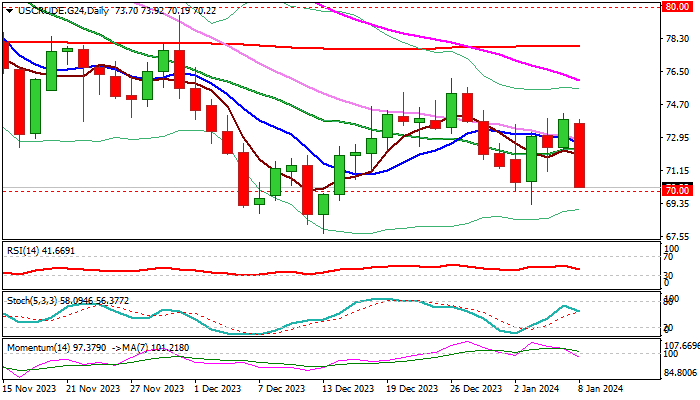

Fresh weakness has so far retraced the largest part of last week’s $69.27/$74.22 recovery leg and pressuring psychological $70 support.

Loss of pivots at $70/$69.27 (psychological / Jan 3 low) would further weaken near-term structure on completion of failure swing pattern on daily chart and risk retest of Dec 13 low at $67.70 (five-month low).

Weakening structure on daily chart (MA’s turned to full bearish setup / falling 14-d momentum broke into negative territory) support the action, with limited upticks (under $72.00 zone) to keep bears in play and offer better selling levels, in the environment of favorable fundamentals.

Res: 70.93; 71.93; 72.22; 72.93

Sup: 70.00; 69.70; 69.27; 68.79