USDJPY – fresh easing warns of recovery stall

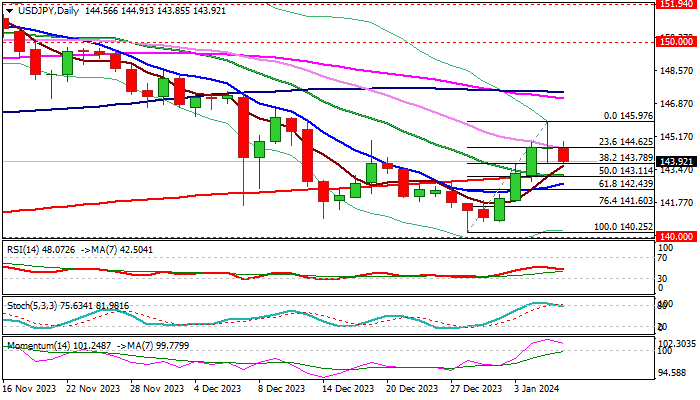

USDJPY eases on Monday, after strong four-day recovery rally stalled just ahead of pivotal Fibo barrier at 146.08 (50% retracement of 151.90/140.25 downtrend) and weighed by a bull-trap above 144.70 (Fibo 38.2% of 151.90/140.25).

Last Friday’s long-legged Doji candle and subsequent drop on Monday, warn of formation of reversal pattern on daily chart, which will look for confirmation on firm break below 143.80 pivot (Friday’s spike low / Fibo 38.2% of 140.25/145.97).

Close below daily Kijun-sen (144.38) is needed keep fresh bears in play for extension towards next key supports at 143.25/11 (200DMA / 50% of 140.25/145.97 recovery leg).

Fading bullish momentum and stochastic emerging from overbought territory on daily chart, support the action.

Markets await release of US December inflation report (due on Thursday) for fresh signals, with weaker than expected numbers to add to bearish near-term outlook, while the upside surprise would provide fresh boost to the greenback for eventual break above 146.08 pivot.

Res: 144.62; 144.95; 146.08; 146.58

Sup: 143.80; 143.25; 143.11; 142.43