WTI OIL rallied to new 3 ½ year high, boosted by escalation of tensions in the Middle East / strong draw in US crude stocks

WTI oil extends strong rally into third straight day on Thursday and hit new 3 ½ year high at $71.86.

Oil prices accelerated sharply higher this week after President Trump announced US withdrawal from nuclear agreement with Iran, additionally boosted by strong draw in US crude inventories (EIA report showed 2.19 million barrels draw last week, compared to 0.2 million barrels draw forecasted) and escalation of tensions between Israel and Iran which threatens to worsen fragile situation in the Middle East and disrupt supply from the region.

In addition, reports showed further rise of US shale oil production which hit all-time high at 10.7 million barrels per day, approaching world’s top oil producer Russia which produces around 11 million barrels per day.

All these factors are supportive for oil price, which could accelerate further, if situation in the Middle East deteriorates.

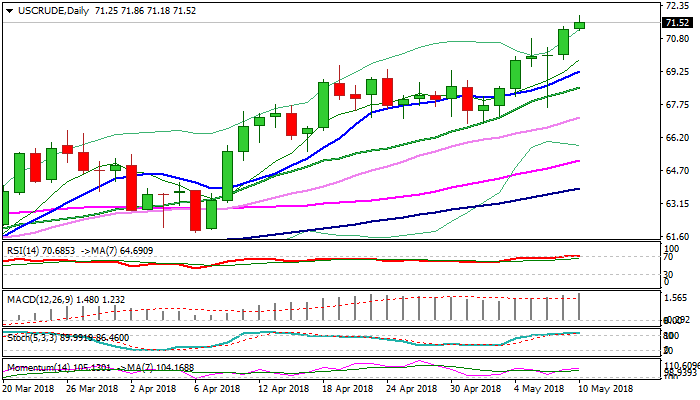

Bullish studies maintain strong momentum and could drive oil price towards next target at $76.35 (Fibo 61.8% of 107.45/$26.04 fall) in coming sessions.

Corrective dips are expected to offer better buying opportunities, with rising 10SMA ($69.26) expected to keep the downside protected.

Res: 71.86; 72.24; 73.00; 73.27

Sup: 71.18; 70.81; 70.00; 69.84