WTI OIL – risk of further easing exists before bulls resume

WTI oil eases on Tuesday but holding near fresh three-week high at $64.22, posted on Monday.

Oil price advanced strongly in previous few sessions, boosted by news about Saudi Arabia’s commitment to continue with production cut program.

Positive sentiment persists, with consolidation and possible deeper pullback on profit-taking and overbought conditions, expected to precede fresh upside.

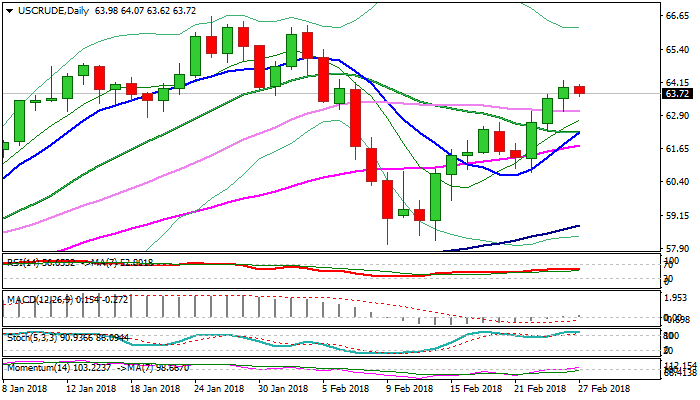

Daily MA’s are in firm bullish setup while 14-d momentum is breaking into positive territory and underpinning bulls.

On the other side, overbought slow stochastic suggests a pause in rally.

Today’s easing was so far shallow and holding well above initial supports at $63.06/$62.80 (30SMA / Fibo 23.6% of $58.19/$64.22 rally), lacking stronger bearish signal which could be generated on reversal of slow stochastic.

Converged 10/20SMA which are about to create bullish cross at $62.27, mark next strong support, along with $61.92 (Fibo 38.2% of $58.19/$64.22 rally), where extended pullback should find ground to avert risk of deeper correction which would sideline bulls.

Bulls keep in focus targets at $64.62 (Fibo 76.4% of $66.64/$58.06 fall) and $65.00 (psychological barrier).

Res: 64.07; 64.22; 64.62; 65.00

Sup: 63.62; 63.06; 62.80; 62.27