WTI OIL stands at the back foot, awaiting crude stocks data for fresh signal

WTI oil price stands at the back foot but holding in tight range on Wednesday, after being hit by unexpected build of US crude stocks (API report released late Tuesday showed build of 4.85 million barrels, compared to 1.85 million barrels draw last week).

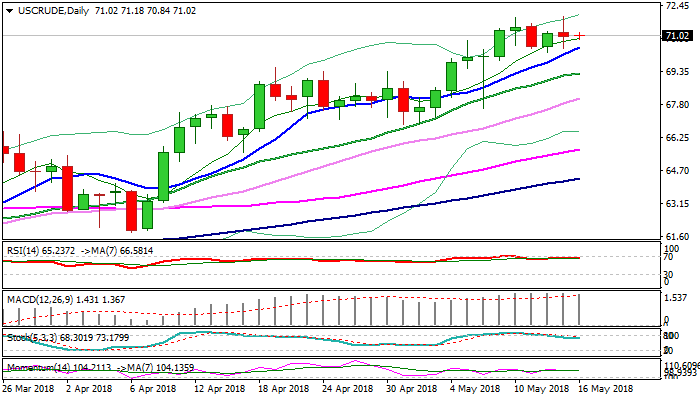

Oil price hit new marginally higher 3 ½ year high at $71.90 on Tuesday but reversed quickly to end day in long-legged Doji.

Overall structure remains bullish and tensions in the Middle East maintains positive sentiment, but fresh strength of the dollar could weigh on oil price.

Rising 10SMA continues to track the advance and marks strong support at $70.45 (along with Monday’s correction low at $70.25) which is expected to hold and keep bulls intact.

EIA weekly crude report is due later today and closely watched for fresh signals. Forecast show draw of 0.76 million barrels vs last week’s draw of 2.2 million barrels and release at /below forecasts would keep oil price supported.

Conversely, oil may come under increased pressure and risk deeper pullback on break below 10SMA, if US crude inventories rise.

Res: 71.18; 71.61; 71.90; 72.48

Sup: 70.84; 70.45; 70.25; 70.00