WTI rises to two-week high, OPEC+ meeting eyed

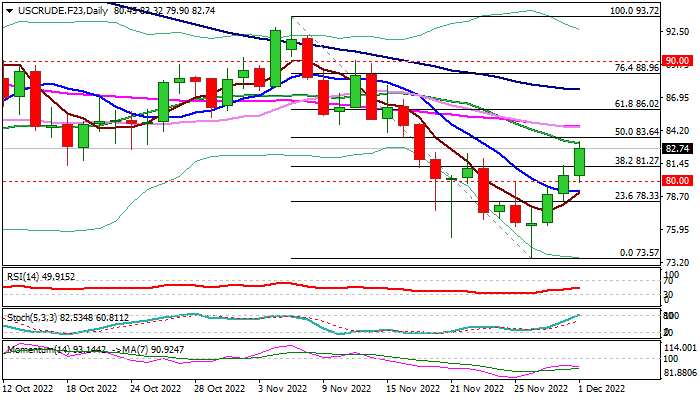

WTI oil price rose further on Thursday, extending gains into third straight day and hitting two-week high ($83.32), where falling 20DMA temporarily capped the advance.

Oil benefited from softer tones from Fed that pressured dollar and two China cities easing Covid restrictions that improved the sentiment and eased concerns about demand.

Markets also speculate that OPEC+ organization, which includes Russia and meets on Sunday, may opt for further supply cut, which would add to growing positive sentiment, although there are no firm signals that the cartel would change its current policy.

Daily studies improved on 5/10DMA’s turning to bullish configuration and on track to form bull-cross, with break and likely daily close above pivotal Fibo barrier at $81.27 (38.2% of $93.72/$73.57) adding to positive signals.

However, 14-d momentum remains deeply in negative territory and stochastic is entering overbought zone, suggesting that bulls may lose traction.

Broken Fibo level ($81.27 )should ideally hold, with broken psychological $80 level, now reverted to significant support, to hold extended dips and keep near-term bulls in play.

Res: 83.32; 83.64; 84.51; 86.02

Sup: 81.27; 80.00; 79.20; 78.33