Yen jumps on unexpected media reports signaling possible policy shift

USDJPY opened with gap-lower on Monday and fell to one week low, following 0.65% drop in Asian session.

Yen received fresh support from media comments which suggest that BoJ Governor Ueda is considering possible change in monetary policy, in quite unexpected signals, as Japan’s policymakers were so far very dovish and recent weaker than expected economic data confirmed the central bank’s stance to keep the policy loose.

The BoJ will continue to watch economic indicators and any future decision is expected to be data-dependent, however, may act in case that inflation sustains above 2% target and economic growth does not slow.

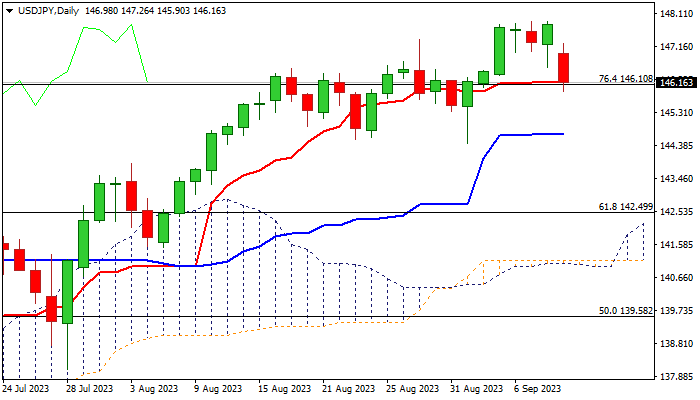

Negative fundamentals also impacted the technical view, as daily studies weakened after the price fell below 146.10 (Fibo 76.4% of 151.94/127.22, former solid resistance, reverted to support and reinforced by daily Tenkan-sen).

Fresh dip needs to register a close below this level to generate initial bearish signal and further weaken near-term structure for extension towards key supports at 144.69 (daily Kijun-sen) and 144.54/44 higher base, loss of which would add to reversal signals and risk deeper pullback.

On the other hand, larger uptrend is still intact and current drop could be seen as a healthy correction if contained above 144.50 support zone.

Res: 146.56; 146.89; 147.26; 147.87

Sup: 145.90; 145.25; 144.69; 144.44