Yen surges as trade crisis deepens

The dollar fell across the board in early US session on Monday as trade crisis between US and China deepens, after China retaliated on US tariff hike on Friday.

China announced its decision to impose tariffs $60 billion worth US goods and may use other tactics in response to US action.

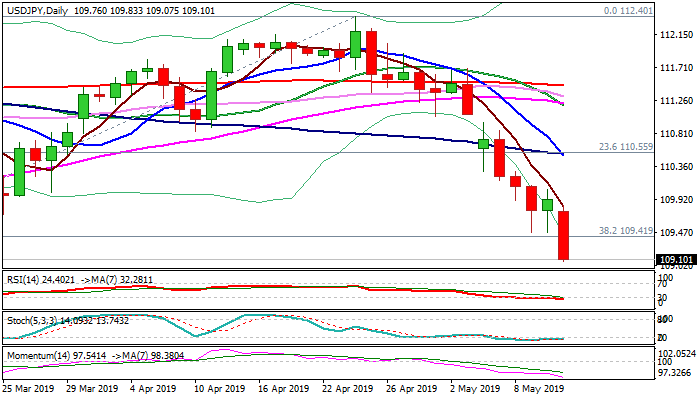

The USDJPY pair fell 0.5% in immediate reaction on the news, surging through important supports at 109.58/41 (weekly cloud base / Fibo 38.2% of 104.59/112.40).

The latest news further soured already negative sentiment, strongly boosting risk aversion mode, with breach of pivotal supports adding to negative outlook.

Bears pressure round-figure support at 109.00 and look for target at 108.49 (50% of 104.59/112.40 / 31 Jan trough), with daily close below broken 109.41 Fibo support, needed for fresh bearish signal.

Rising bearish momentum and multiple daily MA’s bear-crosses) support scenario, but bears may take a breather on profit-taking / oversold daily studies, with upticks expected to offer better opportunities for re-entering bearish market.

Broken supports at 109.41/71 now reverted to solid resistances, with the latter being reinforced by falling 5SMA.

Res: 109.41; 109.71; 109.83; 110.00

Sup: 109.00; 108.49; 107.98; 107.76