Cable lower after US data; focus on UK jobs / inflation data; Brexit talks

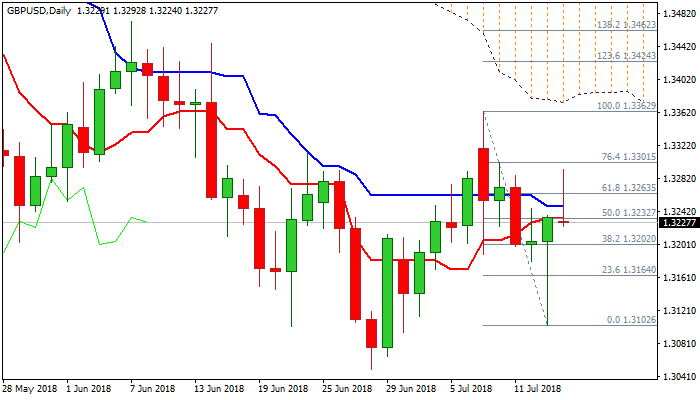

Cable pulled back from daily high at 1.3292, posted in extension of last Friday’s bounce after strong downside rejection at 1.3102, which left hammer candle.

Pound benefited from rising hopes of UK rate hike on Aug 2 BoE MPC meeting, but sentiment was soured of concerns on hard Brexit, keeping the upside attempts limited and away from key barriers at 1.3362 (09 July high) and 1.3472 (07 June high).

Today’s release of US retail sales marked fresh pressure on pound as the June figure came in line with expectations but strong upside revision of previous month’s releases improved the picture and boosted the dollar.

Daily techs are in mixed mode but prevailing tone remains negative as falling and thickening daily cloud continues to produce heavy pressure (cloud top lays at 1.3383).

Near-term focus turns towards tomorrow’s release of UK jobs data (Avg earnings f/c 2.5% unchanged from previous, while jobless claims are forecasted significantly lower in June, 2.3K vs -7.7K prev) and UK inflation data on Wednesday(June f/c 2.6% vs 2.4% prev) which could provide fresh direction signals.

Res: 1.3292; 1.3301; 1.3362; 1.3400

Sup: 1.3224; 1.3202; 1.3180; 1.3102