Cable holds in neutral mode ahead of UK jobs data

Cable ticked higher in early European trading on Tuesday after holding within tight range in Asia, awaiting fresh signals from today’s UK labor data.

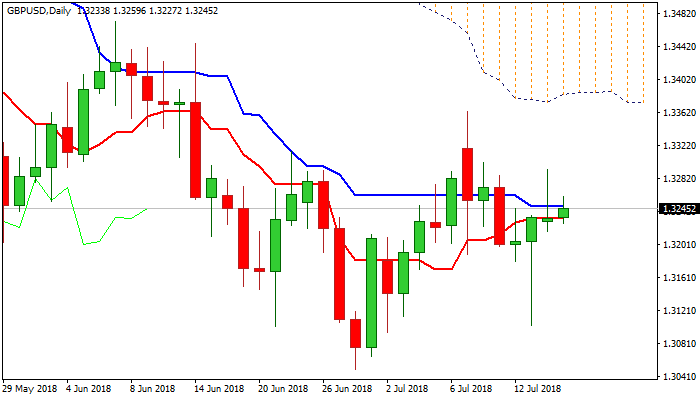

Pound failed to sustain recovery from Friday’s low at 1.3102 as gains stalled at 1.3292 on Monday, with subsequent pullback being driven by solid US retail sales data and rising Brexit concerns.

Monday’s action ended in Doji candle with long upper wick which signaled indecision after strong upside rejection on Monday.

Technical studies continue to give mixed signals as daily MA’s (10/20/30) are in neutral configuration, bullishly aligned momentum and slow stochastic give positive signals, while massive falling daily cloud continues to heavily weigh.

Near-term action is holding between 20 and 30SMA’s (1.3213 and 1.3253 respectively) which mark initial triggers, with break of either side to provide initial direction signal.

Bullish scenario on lift above 30SMA would face next barrier, provided falling 55SMA (1.3338) and expose key resistance at 1.3383 (base of thick daily cloud).

Bearish scenario would be triggered on firm break below 20SMA and would look for retest of Monday’s spike low at 1.3102 on stronger acceleration lower.

UK jobs data are key event for sterling today. Average earnings are forecasted unchanged at 2.5% in May while jobless claims are expected to rise in Jun (2.3K f/c vs -7.7K in May), while unemployment is expected to remain unchanged at 4.2% in May.

Better than expected figures, especially in earnings would spark stronger bullish acceleration, while downbeat numbers would have negative impact.

Res: 1.3253; 1.3292; 1.3338; 1.3383

Sup: 1.3213; 1.3180; 1.3102; 1.3065