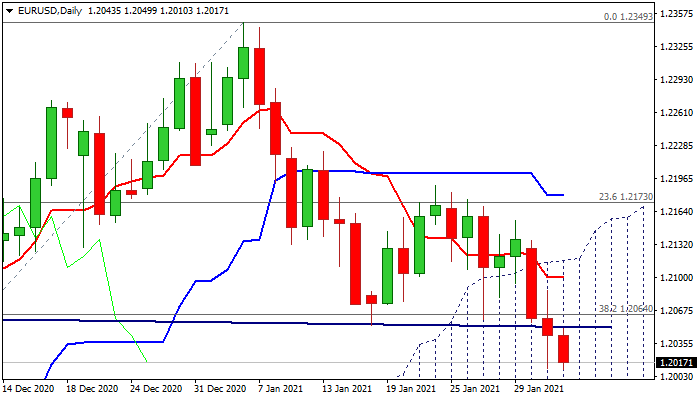

Bears extend deeper in the cloud after completion of H&S pattern

The Euro remains in red for the third day and consolidating under new two-month low at 1.2011, with fresh negative signal being generated on close below pivotal supports at 1.2064/53 (Fibo 38.2% of 1.1602/1.2349 / Jan 18 former correction low).

Bears extended deeper into thick daily cloud and pressure psychological 1.20 support, which guards 1.1975 (50% retracement) and key support at 1.1938 (daily cloud base).

Rising bearish momentum and formation of 10/55DMA’s bear-cross adds to negative signal on completion of head and shoulders pattern on daily chart, but oversold stochastic suggests that bears may take a breather before attacking cloud base.

The neckline of the H&S pattern (1.2051) and broken pivots at 1.2053/64 mark solid barriers which should ideally cap upticks and keep bears intact.

Res: 1.2051; 1.2064; 1.2099; 1.2116

Sup: 1.2000; 1.1975; 1.1938; 1.1905