Dollar remains constructive ahead of Fed verdict

Dollar remains constructive ahead of Fed verdict

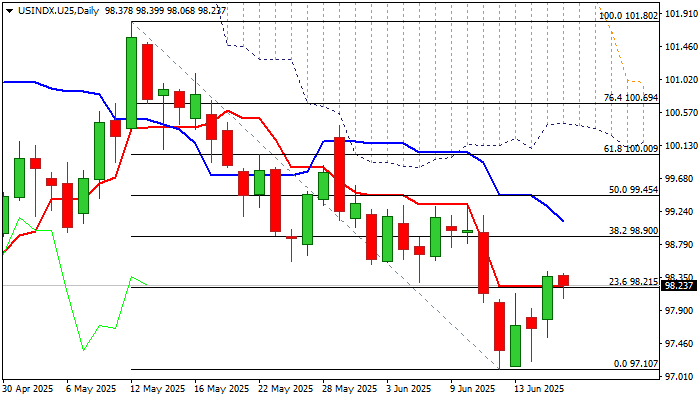

The dollar index held steady and moved within a narrow range following advance in past three days, as traders await announcement from Fed.

The dollar benefited from safe-haven demand on the most recent escalation of conflict in the Middle East, while markets look for more information about Fed’s steps in the near future, as the central bank is widely expected to keep the interest rates on hold at the policy meeting that ends today.

Tuesday’s close above important resistance at 98.21 (daily Tenkan-sen / Fibo 23.6% of 101.80/97.10) was initial bullish signal, which requires repeated closing above this level to be verified.

This would brighten near-term prospects for further recovery and unmask targets at 98.90 (Fibo 38.2%) and 99.10 (daily Kijun-sen). Scenario also includes positive dollar’s reaction to Fed’s decision.

Conversely, failure to sustain break above 98.21 would generate initial signals that bulls are running out of steam and that near-term recovery has likely peaked.

Res: 98.50; 98.90; 99.10; 99.45

Sup: 98.06; 97.65; 97.53; 97.10