Gold hits new record high on weaker dollar / Fed rate cut expectation

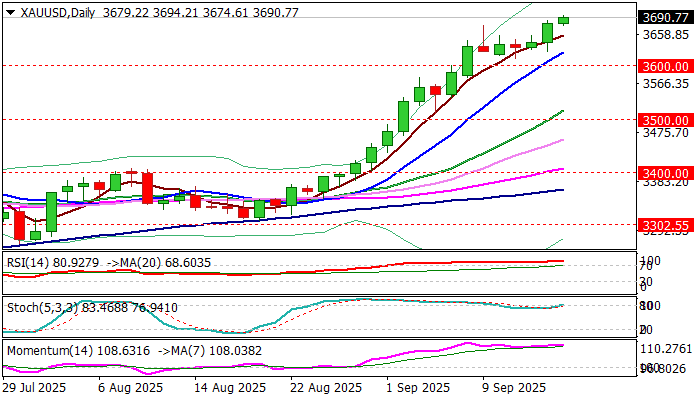

Gold rose to new record highs in late Monday / early Tuesday trading, as bulls regained traction after a narrow consolidation in past four days.

Fresh weakness of US dollar ahead of Wednesday’s Fed rate decision, in which the central bank is widely expected to cut rate by 25 basis points (there is also a small chance for possible 50 basis points rate cut) provided fresh boost to the yellow metal’s price, in addition to deepening political crisis in the US and some EU countries, as well as signals of worsening geopolitical situation.

With rate cut being almost fully priced in, markets await to hear about Fed’s guidance for the near future, with growing hopes that the central bank will remain in a dovish mode that would provide further support for gold.

Psychological $3700 level is under increased pressure, with break here to expose next target at 3734 (Fibo 138.2% projection).

Bulls so far don’t react on overbought daily studies, but some consolidation / shallow correction should be expected in the near term, if current fundamentals remain unchanged.

Res: 3700; 3734; 3750; 3789

Sup: 3674; 3624; 3600; 3577