AUDUSD extends advance after upbeat labor data

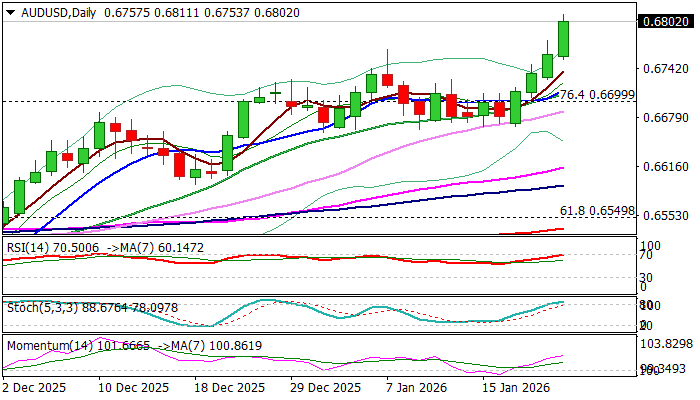

Steep bull-leg from the larger higher base at 0.6665 zone extends into fourth straight day and hit the highest level since late September 2024 on Thursday (0.6811).

The Aussie dollar was inflated by weaker US dollar on the recent rally into safety of precious metals, following escalation of conflict between the US and EU over Greenland, while upbeat Australia’s December labor report further lifted the currency.

Employment unexpectedly rose to more than double value of forecast and negative and downwardly revised November’s figure, with strong drop in unemployment (Dec 4.1% vs 4.4% f/c and Nov 4.3%) brightening the sentiment and boosting expectations that the RBA may opt for a rate hike in February policy meeting following strong improvement in the labor sector.

Markets focus on next week’s release of inflation data, which is expected to provide final touch to the RBA’s monetary policy decision.

Daily studies remain in full bullish configuration, although overbought conditions warn that bulls may start to lose traction, but strong positive signals have also developed on weekly chart (bullish continuation pattern / 10/200WMA golden-cross) and expected to contribute to bullish outlook.

Daily close above broken Fibo 76.4% (0.6699) is minimum requirement to keep bulls in play, while sustained break above cracked 0.6800 level would provide fresh impetus for acceleration towards 0.6900 (round figure) and 0.6942 (Sep 30 2024 peak).

Res: 0.6811; 0.6850; 0.6900; 0.6942

Sup: 0.6766; 0.6738; 0.6699; 0.6665