Yen extends strong post- election advance through key technical levels

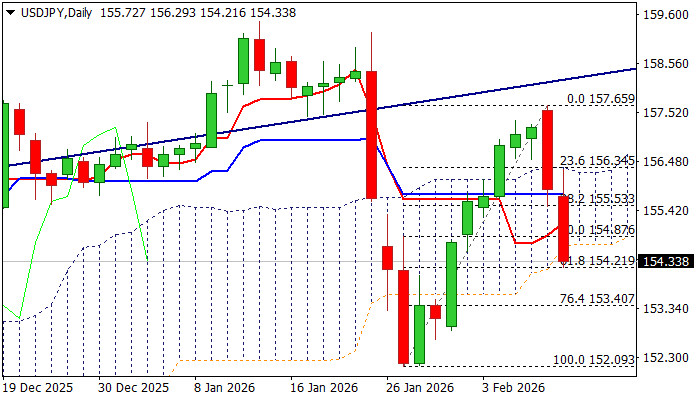

USDJPY extends steep fall (from 157.65 lower top of Feb 9) into second straight day, as Japanese currency rallied after PM Takaichi’s election victory boosts prospects for stronger economic growth as well as brightens outlook for more hawkish stance on monetary policy.

Revived talks about potential intervention also contributed to yen’s fresh strength.

The pair was down 2% since Monday’s opening, with growing prospects for further weakness after the latest acceleration lower broke some important technical levels.

Fresh weakness surged through ascending daily Ichimoku cloud (spanned between 156.34 and 154.68), while today’s action emerged below cloud and dented Fibo support at 154.26 (61.8% retracement of 152.10/157.65 upleg), reinforced by 100DMA).

Strengthening negative momentum and most of MA’s being in bearish setup on daily chart, support negative scenario.

Close below cloud base is needed to validate signal, with firm break of 154.26 pivot to further weaken near-term structure for attack at 153.40 (Fibo 76.4%) and unmask key support at 152.10 (Jan 27/28 higher base).

Res: 154.68; 155.00; 155.53; 155.77

Sup: 154.21; 153.40; 152.86; 152.10