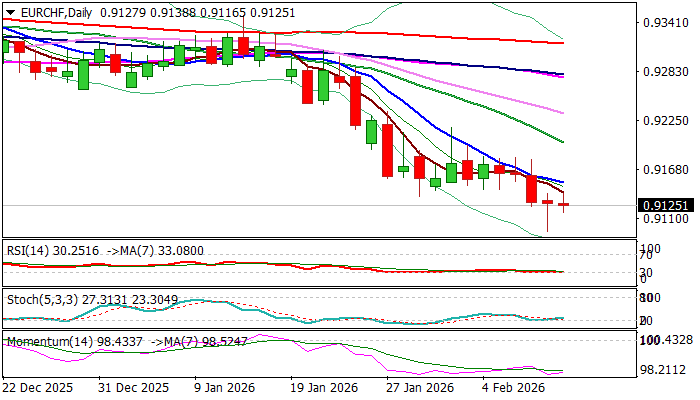

EURCHF – bears take a breather above new 11-year low, key 0.90 support in focus

EURCHF is consolidating under new multi-year low at 0.9094 (the lowest since Jan 2015 when the SNB abandoned its minimum exchange rate policy of 1.20 CHF per Euro) that was hit on Tuesday.

Swiss franc remains well supported on ongoing safe-haven demand and continues to advance against its major peers.

Bears eye key supports at 0.9000 zone (psychological / Jan 2015 spike low) which could be reached soon, as overall environment remains supportive.

Tuesday’s Doji candle with long tail, points to growing bids which may pause larger downtrend for consolidation or possible limited correction, as daily studies are overstretched.

Technical picture remains firmly bearish and suggest that brief breather would mark positioning for fresh push lower.

Falling 10 DMA (0.9152) marks initial resistance, followed by more significant 0.9200 zone (Fibo 38.2% of 0.9289/0.9094 bear-leg / falling 20DMA) which should cap upticks.

Res: 0.9094; 0.9152; 0.9200; 0.9222

Sup: 0.9116; 0.9094; 0.9050; 0.9000