Bearish sentiment after rate decision as BoE is not in hurry for further hikes

Cable slumped near psychological 1.30 support, following short-lived post-BoE spike to 1.3124, as post-rate decision comments from BoE Governor Carney soured the sentiment.

The Bank of England raised interest rates by quarter of point as expected, with unanimous 9-0 vote giving initial boost the pound.

Dovish hike left sterling little space for advance as Carney poured cold water by comments that the central bank is not in hurry to further raise rates, as rising uncertainty over Brexit overshadows the outlook.

The central bank signaled that next hike could not be expected before the first half of the next year, if there will be sufficient evidence that UK economy is doing well and more important if Brexit talks go smoothly.

On the other side, disorderly Brexit could keep the central bank on hold for extended period of time, which would be negative scenario for sterling.

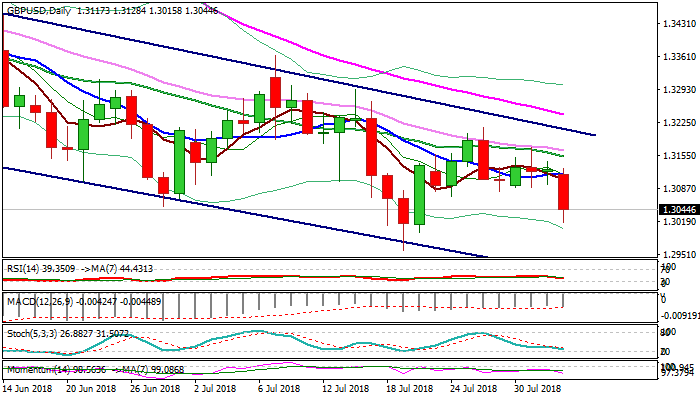

Bounce from session low at 1.3015 proves 1.30 zone as strong support, with further hesitation to be expected before final break lower.

However, firmly bearish daily techs, accompanied with negative sentiment, suggest limited recovery and keep strong bearish bias in play for further weakness.

Res: 1.3085; 1.3120; 1.3153; 1.3167

Sup: 1.3015; 1.3000; 1.2957; 1.2897