Direction signal on break of converging 10 or 20SMA

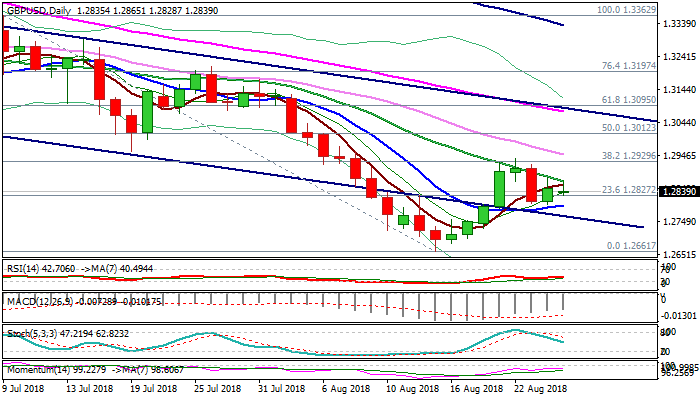

Cable holds in tight range and directionless mode in early Monday’s trading, as falling 20SMA (currently at 1.2868) continues to cap, but pullback from recovery high at 1.2936 (22 Aug) has so far been contained by north-turning 10SMA (1.2798).

Converging MA’s keep near-term action within narrowing range, helped by flat momentum and RSI.

Break of either boundary would provide fresh direction signal, with return below 10SMA to expose 15 Aug low at 1.2661, while lift above 20SMA would open pivotal barrier at 1.2930 (Fibo 38.2% of 1.3362/1.2661 / 22 Aug high).

Overall structure is bearish on daily chart, but bullish signals are developing on weekly chart. Momentum is heading north, slow stochastic reversed from oversold territory and Doji reversal pattern is forming but needs confirmation on sustained break above 1.2930 pivot.

Res: 1.2868; 1.2918; 1.2930; 1.2957

Sup: 1.2828; 1.2798; 1.2759; 1.2729