WTI holds negative near-term tone after strong upside rejection

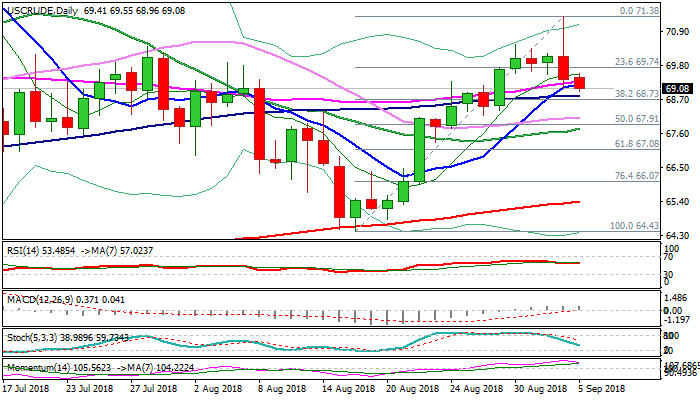

WTI oil price stands in red and below thin daily cloud, following previous day’s bearish close after bulls were strongly rejected at $71.38 and subsequent quick pullback returned and closed below $70 handle.

Concerns about negative impact from hurricane at US Gulf coast kept oil price well supported on Tuesday, however, bulls quickly lost traction after hurricane turned to tropical storm and had lower impact on oil infrastructure in the Gulf of Mexico than initially estimated.

Quick reversal weakened oil’s near-term techs, turning focus lower, as momentum weakens on daily chart and supports scenario.

Bears eye pivotal support at $68.73 (Fibo 38.2% of $64.43/$71.38) loss of which would generate fresh bearish signal for deeper pullback from $71.38 spike high.

Negative near-term tone could persist while the price remains below daily cloud.

Releases of US crude inventories (API report will be released later today and EIA report on Thursday) would generate fresh direction signals.

Res: 69.46; 70.00; 70.48; 71.17

Sup: 68.96; 68.73; 67.91; 67.08