Weekly close above 200WMA to open way towards 114.74; consolidation to precede

The dollar hit new nine-month high against yen at 113.64 in Asian session on Friday, in extension of 0.58% advance previous day.

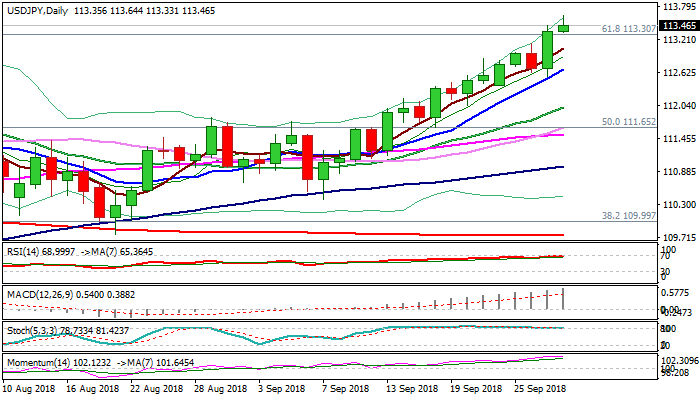

Hawkish Fed and upbeat US data boosted the greenback, which generated strong bullish signal on Thursday’s close above pivotal barriers at 113.17/30 (19 July high / Fibo 61.8% of 118.66/104.63 descend / weekly 200SMA).

Bulls show hesitation on approach to next target at 112.74 (12 Dec 2017 high), with consolidation being so far contained above broken Fibo barrier (113.30), but deeper pullback cannot be ruled out as slow stochastic is reversing from overbought territory on daily chart and pre-weekend profit-taking could delay bulls.

Also, better than expected Japan’s housing data in Aug, offered temporary support to yen.

Dips could extend towards 113.00 zone on break below initial supports at 113.30/17, with extended pullback expected to find support above rising 10SMA (112.67), to mark the action as positioning for fresh upside.

Clear break above 113.74 barrier would expose target at 114.73 (06 Nov 2017 high).

The pair is on track for the third weekly strong bullish close which supports scenario of further advance, with weekly close above broken weekly 200SMA to provide strong bullish signal.

Res: 113.64; 113.74; 114.00; 114.36

Sup: 113.33; 113.24; 113.04; 112.67