Turkish lira showed limited reaction on Turkey’s CPI shock

The USDTRY jumped to 6.10 on Wednesday, after news showed Turkish inflation surged in September.

Monthly figure came at 6.3%, well above forecasted 3.6% and 2.3% previous month, while annualized CPI jumped to 24.5% from 17.9% previous month.

The pair was up around 1.8% after release, with action seen as rather mild and limited, compared released figures, encouraging.

However, downbeat inflation data is negative signal for further weakening of lira.

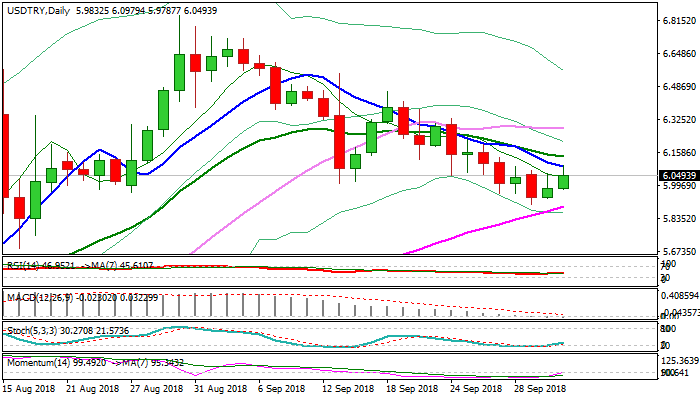

Break above pivotal barrier at 6.1183 (Fibo 38.2% of 6.4630/5.9053 / daily Tenkan-sen) is needed to signal further upside towards 20SMA (6.1413) and next pivot at 6.25 (Fibo 61.8% of 6.4630/5.9053).

The notion is supported by strengthening momentum which attempts to break into positive territory, as well as north-heading slow stochastic which reversed from oversold territory.

Conversely, bears may run out of steam if 6.1183 pivot stays intact, with stronger bearish signal expected on firm break below 5.9053 (01 Oct low).

Res: 6.0979; 6.1183; 6.1841; 6.2500

Sup: 5.9850; 5.9787; 5.9320; 5.9053