Italy / Brexit news keep the cross under pressure; oversold techs warn

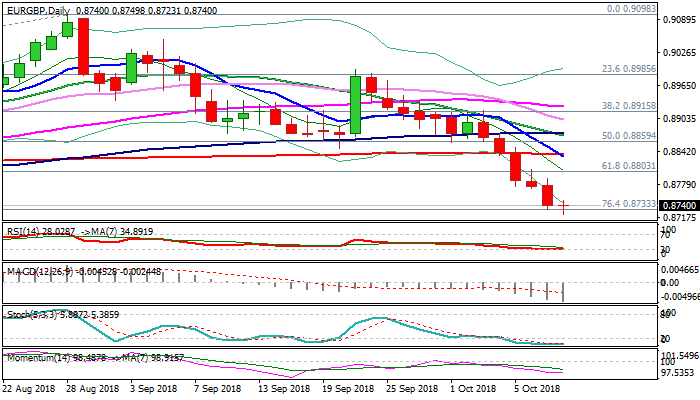

The cross is consolidating within narrow range, above new low at 0.8723 (the lowest since 15 June) posted today.

Extension of bear-leg from 0.8988 (24 Sep high) cracked target at 0.8733 (Fibo 76.4% of 0.8620/0.9098 ascend) but without clear break lower so far.

Negative sentiment was boosted by increased Brexit deal hopes and persisting concerns over Italy’s budget which maintains pressure on Euro.

Strong bearish momentum on daily chart and formation of 10/200SMA death-cross reinforce bearish structure, however, oversold daily RSI / slow stochastic suggest that larger bears may take a breather in coming sessions.

Indicators so far move in sideways mode, lacking firmer bullish signal and keeping upside attempts limited for now.

Extended consolidation could be likely near-term scenario before fresh direction signal is generated.

At the upside, base of weekly cloud which twisted on Monday and is thickening / broken Fibo 61.8% of 0.8620/0.9098, mark solid resistance at 0.8805, which is expected to ideally cap, guarding next strong barrier at 0.8835 (converged 10/200SMA’s).

Clear break of Fibo support at 0.8733 would signal bearish continuation towards 0.8697 (29 May trough) and unmask key support at 0.8620 (17 Apr low).

Res: 0.8750; 0.8805; 0.8835; 0.8870

Sup: 0.8723; 0.8697; 0.8680; 0.8620