Weak PMI data push Euro below 1.1432 base; ECB eyed for fresh signal

The Euro stands at the back foot and probing below 1.1432 base, pressured by weaker than expected German / EU PMI data (German Manufacturing Oct 52.3 vs 53.5 f/c / Services Oct 53.6 vs 55.5 f/c) ( EU Manufacturing Oct 52.1 vs 53.0 f/c / Services 53.3 vs 54.5 f/c).

Signs that bloc’s economic growth could be slowing, puts the single currency under increased pressure.

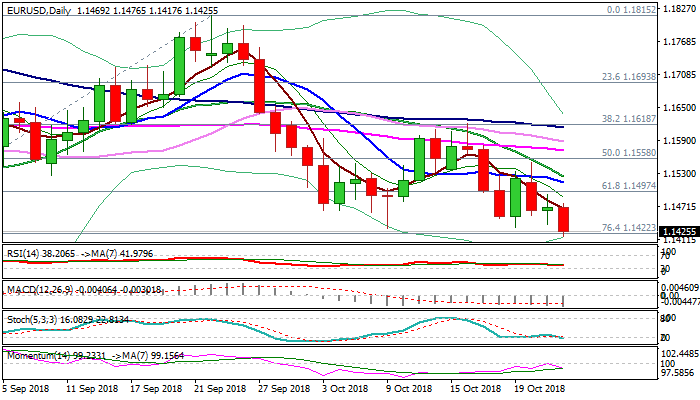

Bears are regaining control after Tuesday’s long-legged Doji signaled indecision, as daily techs are negative and favor further downside on eventual break through key supports at 1.1432 (base) and 1.1422 (Fibo 76.4% of 1.1300/1.1815 ascend).

Close below 1.1432/22 pivots would open way towards key med-term support at 1.1300 (15 Aug low, the lowest since June 2017).

ECB’s policy meeting on Thursday is in focus and could spark fresh volatility as weak data today could be an obstacle for hawks.

Res: 1.1476; 1.1497; 1.1513; 1.1525

Sup: 1.1394; 1.1366; 1.1335; 1.1300