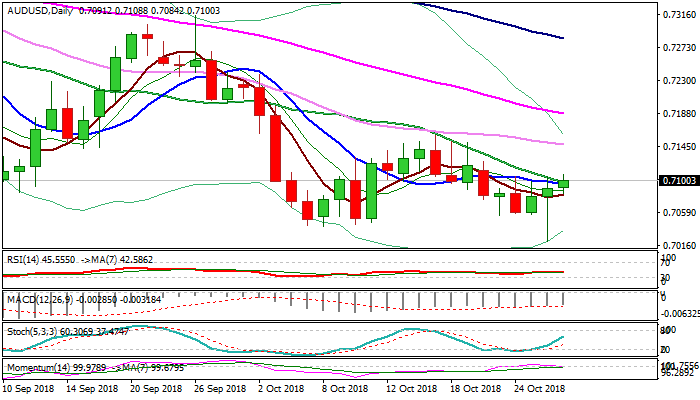

Recovery needs break above converged MA’s for bullish signal

The Australian dollar stands at the front foot on Monday and cracked key barriers at 0.7095/97 (converged falling 10/20SMA’s), following strong downside rejection on Friday, when the pair spiked to new low at 0.7020 (the lowest since late Jan 2016), but losses were short-lived.

Close above MA’s and Fibo barrier at 0.7106 (61.8% of 0.7159/0.7020) would generate bullish signal for further recovery.

Conflicting daily indicators (north-heading slow stochastic / weakening momentum) and mixed setup of daily MA’s, so far lack stronger direction signal.

Broken 5SMA (0.7081) marks initial support, loss of which would weaken near-term structure.

Res: 0.7108; 0.7126; 0.7147; 0.7159

Sup: 0.7081; 0.7055; 0.7040; 0.7020