Outcome of Trump/Xi meeting could result in test of 200SMA or daily cloud top

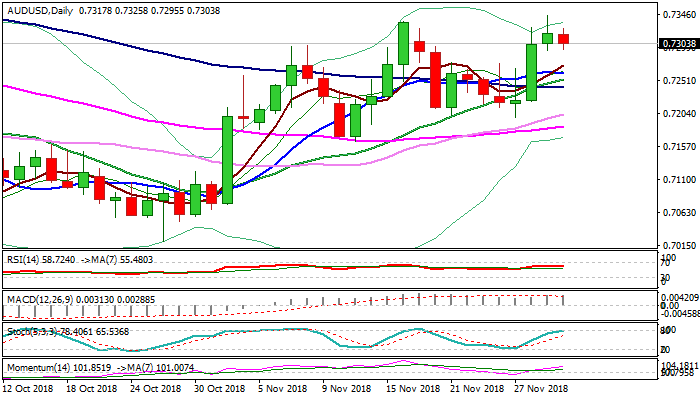

The Aussie dollar moved lower on Friday after strong rally in past two days hit new three-month high at 0.7344 on Thursday but failed to close above previous peak at 0.7335 (16 Nov).

Long upper shadow on Thursday’s daily candle signal upside rejection which could result in further easing, as traders booked profits after rally failed to resume on initial attempt through 0.7335 pivot and weaker than expected China’s PMI data added to negative near-term tone.

Bullish daily techs maintain strong momentum and suggest that current pullback could be positioning for fresh upside.

Extended dips should find support above 10SMA (0.7261) to keep bullish structure intact, however, negative signal could be expected on repeated weekly close below falling 30WMA (0.7323) which capped the action in past two weeks.

G 20 meeting over the weekend and Trump / Xi meeting is in focus as top event. Any signs of progress in talks would boost Aussie dollar, which could accelerate towards 200SMA (0.7419).

Conversely, the Australian dollar may suffer stronger losses on signs of escalation of trade conflict and could accelerate towards daily cloud top at 0.7200.

Res: 0.7325; 0.7344; 0.7381; 0.7419

Sup: 0.7288; 0.7264; 0.7253; 0.7233