WTI pauses after strong fall but risk of deeper fall exists as sentiment weakened after Trump’s message to OPEC

WTI oil ticked higher from new 1 ½ week low at $55.01 on Tuesday, following 3% fall on Monday, which marked the biggest one-day loss since 24 Dec.

Oil prices came under increased pressure after President Trump’s message to OPEC, in which he pointed to too high oil prices and urged the cartel to curb efforts to further boost prices.

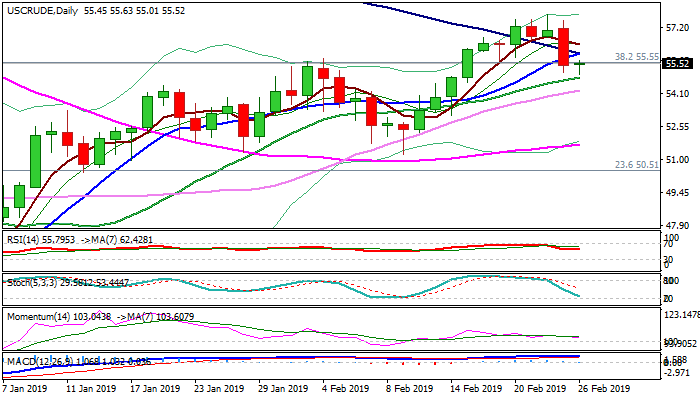

Fresh bears surged through 100SMA and generated further bearish signal on marginal close below broken Fibo barrier at $55.55 (38.2% of $76.88/$42.36) and brief probe below pivotal support at $55.28 (Fibo 38.2% of $51.23/$57.79).

Dip found footstep just above rising 20SMA ($54.84), but lack momentum for stronger recovery.

While the price holds below falling 100SMA ($55.98), risk for further weakness is expected to remain in play.

Sustained break below cracked $55.28) Fibo support would add to negative signals, with loss of 20SMA needed to confirm negative near-term stance and risk fresh bearish acceleration towards $54.23 (30SMA) and $53.74 (Fibo 61.8% of $51.23/$57.79) in extension.

Traders will look for release of US crude stocks reports (API, due later today and EIA on Wednesday) for fresh signals.

Res: 55.63; 55.98; 56.41; 57.51

Sup: 55.28; 55.01; 54.51; 54.23