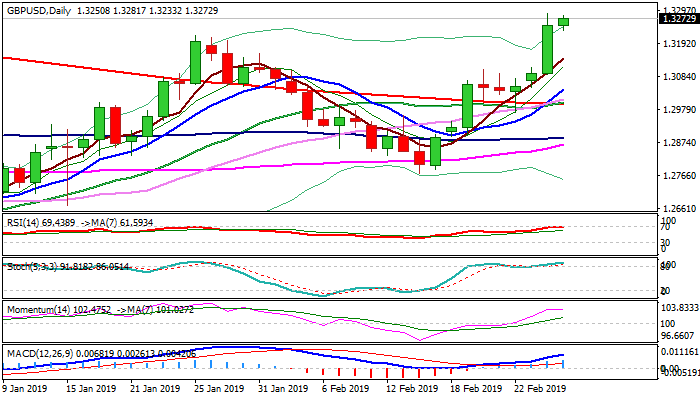

Bulls look for extension towards targets at 1.3297/1.3315, following Wed’s 1.1% advance

Cable stands at the front foot in early Wednesday’s trading and consolidates under new 2019 high at 1.3287, posted after Tuesday’s 1.1% rally (the biggest one-day gains since 1 Nov).

Overnight’s easing was brief and stayed above broken former high (1.3217), keeping strong bullish stance intact.

Optimism on sidelined no-deal scenario and signals of delayed Brexit keep pound well supported for now.

Bulls penetrated thick weekly cloud and eye barriers at 1.3297 (20 Sep high) and 1.3315 (FE 100% of the third wave of five-wave cycle from 1.2772 (14 Feb low), break of which is needed to validate wave principles and expose targets at 1.3387/97 (Fibo 50% of larger 1.4376/1.2397 fall / FE 123.6% of wave C from 1.2968 trough).

Bullish daily / weekly studies support scenario (formation of triple golden cross of 10/20/30 SMA’s over 200SMA adds to positive signals), but consolidative/ corrective action could be anticipated on overbought conditions on daily chart.

Former high and converged 55/100WMA’s mark strong supports at 1.3200/40 zone, which are expected to ideally contain and guard rising 5SMA (1.3143).

Rising 10SMA (1.3043) marks pivotal support, violation of which would sideline bulls.

Res: 1.3297; 1.3315; 1.3397; 1.3448

Sup: 1.3240; 1.3200; 1.3143; 1.3112