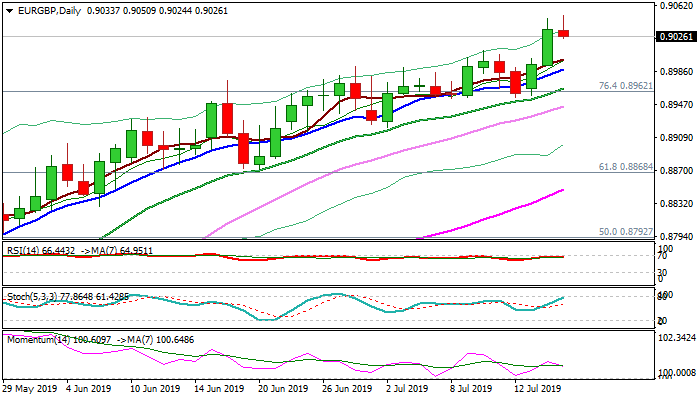

The cross holds above 0.90 level but risk of pullback on profit-taking exists

The cross is attempting to establish above broken psychological 0.90 level after hitting new high at 0.9050 (the highest since 11 Jan) on Wednesday.

Steep 2 ½ month uptrend accelerated on Tuesday and closed above 0.90 barrier for the first time since 9 Jan after pound was hit by overall negative UK labor data, while today’s UK CPI in line with expectations, showed no significant impact on pound.

Strong negative sentiment on fears of no-deal Brexit was fueled by pessimistic comments from UK officials who see no possibility of approving current Brexit deal without changes.

On the other side, profit-taking after bulls reached certain targets, can push the price lower into adjustment.

Weaker momentum on daily chart supports the notion, with limited dips expected to find ground at 0.8987/66 zone (rising 10/20DMA’s) to keep immediate bulls intact and prevent deeper pullback towards troughs at 0.8920 and 0.8872.

Res: 0.9050; 0.9061; 0.9087; 0.9113

Sup: 0.9000; 0.8987; 0.8966; 0.8920