Bullish signal on break above 200DMA but daily techs warn of recovery stall

The pair maintains firm tone, additionally boosted by fresh optimism on positive comments over trade talks from President Trump.

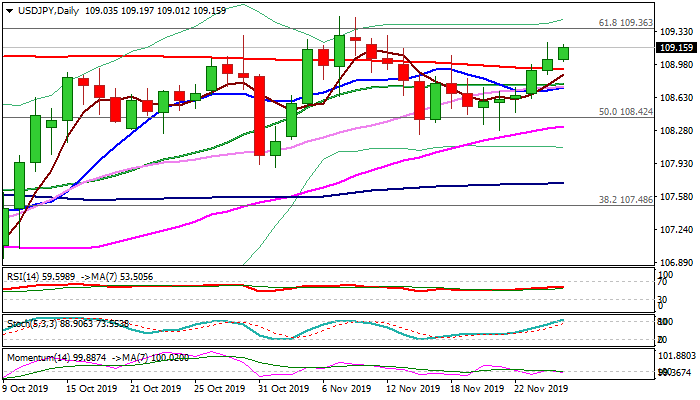

Bounce from 108.25 higher base reached Fibo 76.4% of 109.48/108.27 pullback and generated bullish signal on Tuesday’s break and close above 200DMA (108.92) which capped the action in past two weeks.

Bulls are underpinned by rising daily cloud and Tenkan-sen / Kijun-sen lines in bullish setup, but warning that recovery may lose traction comes from rising bearish momentum and overbought stochastic on daily chart.

Near-term action is expected to maintain bullish bias while holding above 200DMA, with firm break above 109.20 Fibo barrier to expose key obstacles at 108.36/48 Fibo 61.8% of 112.40/104.44 / 7 Nov high).

Caution on return and close below 200DMA which would generate initial signal of recovery stall and risk deeper fall.

A batch of data from the US, due later today, is eyed for fresh signals.

Res: 109.20; 109.36; 109.48; 110.00

Sup: 109.01; 108.92; 108.74; 108.62