Gold advances on pre-holiday safe haven demand

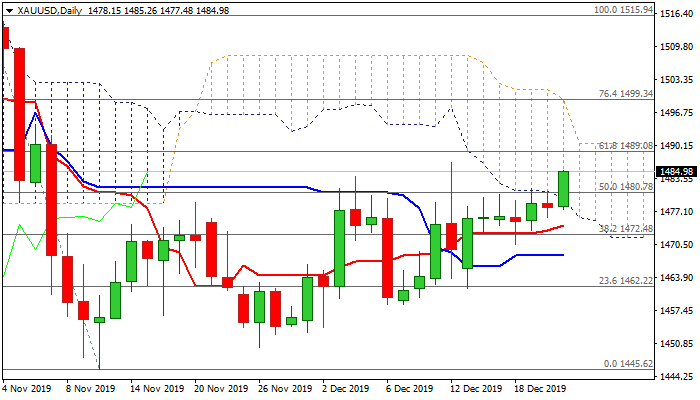

Spot gold jumped above multi-day congestion tops at $1480 zone on Monday and penetrated thick daily cloud ($1479/$1490).

Fresh advance signals continuation of larger uptrend which repeatedly failed to clearly break $1480 Fibo barrier (50% retracement of $1515/$1445).

Safe-haven demand ahead of holidays inflated gold price on Monday, but we remain cautious as bullish momentum on daily chart continues to fade and stochastic is entering overbought zone, which could result in rally’s stall on approach to pivotal Fibo barrier at $1489 (61.8% of $1515/$1445).

Broken barriers at $1479/78 (daily cloud base / 55DMA) now reverted to supports which are expected to hold and keep fresh bullish bias, while break below rising 10DMA ($1475) would generate negative signal and risk deeper fall.

Conversely, strong bullish signal could be on firm break above $1489/90 pivots (Fibo 61.8% / daily cloud top).

Res: 1485; 1489; 1490; 1494

Sup: 1480; 1478; 1474; 1472