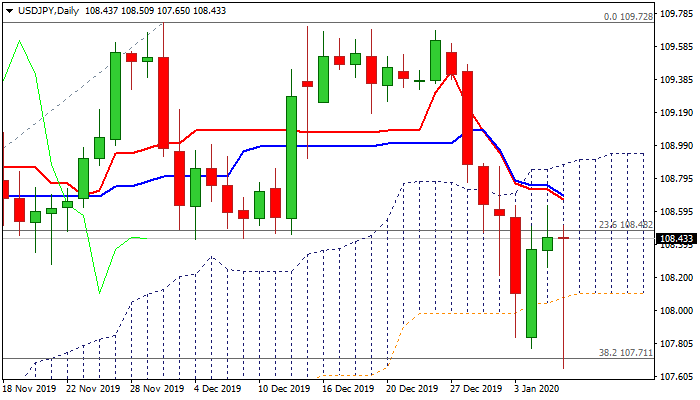

Another strong downside rejection adds to reversal signals but geopolitics keep the downside at risk

Japanese yen surged to new three-month high against the dollar (107.65) on risk aversion after Iran fired rockets on US targets, but gains were short-lived as the greenback regained traction on mild reaction from the US and fading fears of escalation of the conflict, bouncing back to 108.50 zone.

Another strong rejection under daily cloud base and below pivotal Fibo support at 107.71 (38.2% of 104.44/109.72), increase risk of bears’ stall and possible reversal, as bear-trap pattern is forming on daily chart.

Scenario would require further upside extension and close above key barriers at 108.87/90 (daily cloud top / Fibo 61.8% of 109.68/107.65 bear-leg) for confirmation.

Despite today’s strong recovery, caution is required as weak daily momentum and MA’s in bearish setup continue to warn and keep the downside vulnerable, with risk of fresh tensions that may boost again demand for safe-havens and inflate yen.

Break of key supports at 108.10 (daily cloud base) and 107.71 (Fibo) would signal continuation of larger downtrend from 109.70 zone.

Res: 108.50; 108.63; 108.87; 109.01

Sup: 108.20; 108.10; 107.77; 107.65