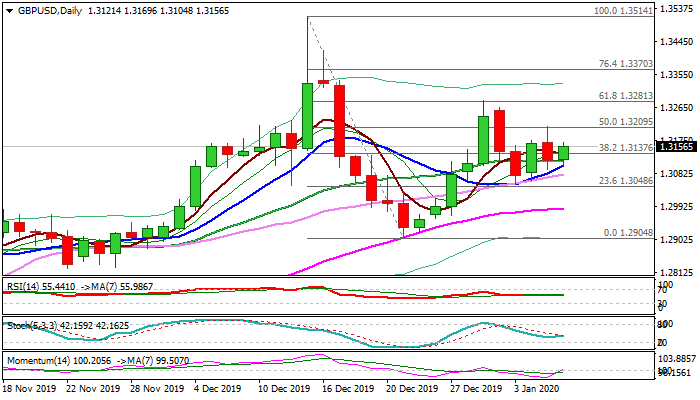

Slight bullish bias keeps key 1.32 resistance zone in focus

Cable edged higher in early European trading on Wednesday, boosted by fresh risk appetite after mild reaction of the US on Iran’s attack overnight.

Fresh advance focuses again 1.3200 zone where Tuesday’s action stalled, as the downside remains protected by rising 10DMA for the fourth consecutive day.

Improving daily studies (momentum is attempting to break into positive territory / MA’s in bullish setup / stochastic heads north) and upbeat UK housing data (Dec HPI m/m 1.7% s 0.6% f/c / Dec y/y 4.0% vs 1.5% f/c) maintain positive bias, but caution on extended range trading as daily RSI is still neutral.

Firm break above 1.32 zone (50% of 1.3514/1.2904 / daily Kijun-sen) is required to confirm and signal further advance.

Conversely, initial negative signal could be expected on violation of 10DMA (1.3105) that would expose range floor (1.3053) and risk retest of psychological 1.30 support.

Res: 1.3169; 1.3205; 1.3212; 1.3265

Sup: 1.3137; 1.3105; 1.3082; 1.3053