The Euro stands at the front foot ahead of today’s key events

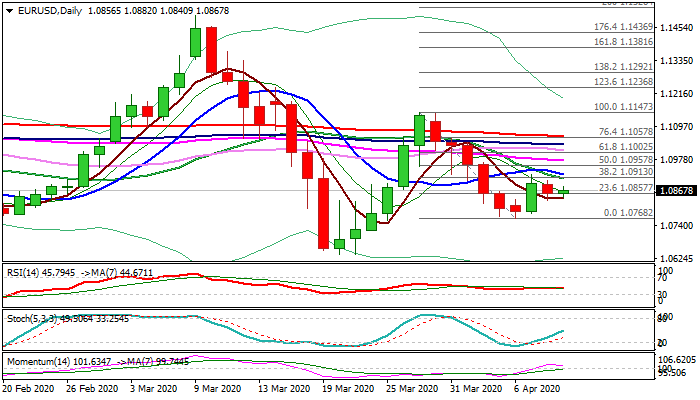

The Euro edged higher after Wednesday’s fall as bullish momentum on daily chart exists and thin rising daily cloud attracts.

Slight optimism in the market also helps but strong resistances that lay ahead and double recovery failure suggest that upside attempts might be limited.

Eurogroup meeting is in focus today and if EU fin mins reach the deal in funding the common response to the crisis, the single currency may receive fresh boost.

US jobless claims are also on the list of key events today (5.25 mln f/c vs previous week’s record 6.6 mln) and could influence Euro’s performance if figures rise above expectations that could be very likely scenario.

Falling converged 10/20DMA’s offer solid resistances at 1.0910/24 zone (also Fibo 38.2% of 1.1147/1.0768) with firm break here to open way for stronger recovery towards 1.0975 (55DMA) and psychological 1.10 barrier (also Fibo 61.8% of 1.1147/1.0768).

Sideways-moving 5DMA (1.0842) holds the action of Wed/today and marks pivotal support, loss of which will generate negative signal.

Res: 1.0882; 1.0910; 1.0924; 1.0957

Sup: 1.0842; 1.0830; 1.0800; 1.0783