Extended rally focuses key barriers

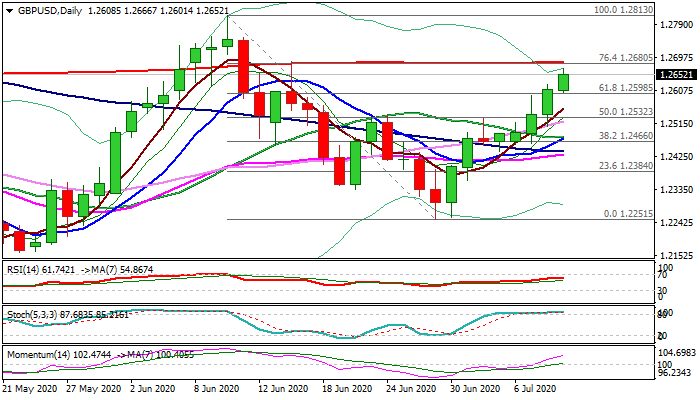

Cable extends advance into fourth consecutive day and hits new three-week high on Thursday, up 1.4% since Monday.

Strong risk sentiment and optimism over EU/UK trade talks continues to boost sterling, with Wednesday’s close above 1.2598 (Fibo 61.8% of 1.2813/1.2251) generating bullish signal.

Today’s extension higher approaches strong barriers at 1.2680/87 (Fibo 76.4% / 200DMA), break of which would open way towards weekly cloud top (1.2736) and unmask 10 June peak at 1.2813.

Rising bullish momentum on daily chart supports the advance, but overbought stochastic warns that bulls may take a breather and consolidate before resuming through 200DMA.

Dip-buying above 1.2606/1.2598 (broken 55WMA / Fibo 61.8%) is seen as favored scenario, with weekly close above these levels needed to confirm strong bullish stance.

Res: 1.2666; 1.2687; 1.2736; 1.2753

Sup: 1.2625; 1.2598; 1.2556; 1.2532