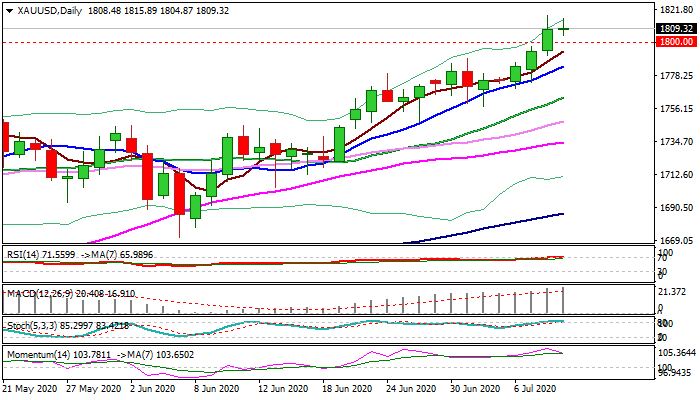

Bullish bias above $1800 but bulls may hold in extended consolidation before resuming

Spot gold continues to shine and accelerates higher in early US session on Thursday after the consolidation under new multi-year high ($1818) found footstep above $1800 level which now acts as strong support.

Wednesday’s break and close above significant $1795/$1802 resistance zone (former highs / psychological level) generated strong bullish signal, which will require weekly close above $1800 mark for confirmation.

Bulls eye initial target at $1823 (Fibo 161.8% projection of the upleg from $1670) and could extend towards $1837 (176.4% projection) and $1850 (round-figure), however, weakening bullish momentum and overbought stochastic on daily chart, warn of extended consolidation before bulls resume.

Extended dips should be contained above $1789 (1 July former high / rising daily Tenkan-sen) to keep bulls intact.

Res: 1815; 1818; 1823; 1837

Sup: 1804; 1800; 1795; 1789