Dollar index eyes key supports, weighed by strong risk appetite

The dollar index is probing again through 92.00 handle in early Wednesday’s trading, remaining under pressure on strong rise in risk appetite on start of transition in the White House and hopes that Covid-19 vaccine will be ready soon.

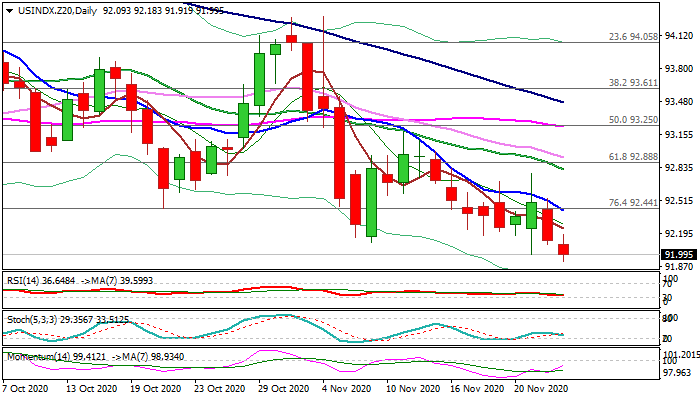

Fresh weakness pressures key supports at 91.91/83 (double-Fibo – 38.2% of 72.69/103.80 / 76.4% of 88.14 /103.80), 91.77 (monthly cloud base) and 91.71 (1 Sep low), break of which would open way for extension towards next key levels at 90.00 (psychological) and 88.24 (50% of 72.69/103.80).

Bears may take a breather before final break as bearish momentum on daily chart is fading and weekly stochastic is oversold.

Fresh shorts on correction remain favored, with falling 10 DMA (92.42) expected to ideally cap, but stronger upticks towards next key barrier at 92.81 (falling 20DMA) cannot be ruled out.

Res: 92.18; 92.24; 92.42; 92.81

Sup: 91.91; 91.83; 91.71; 90.99